Global Dessert Wine Market

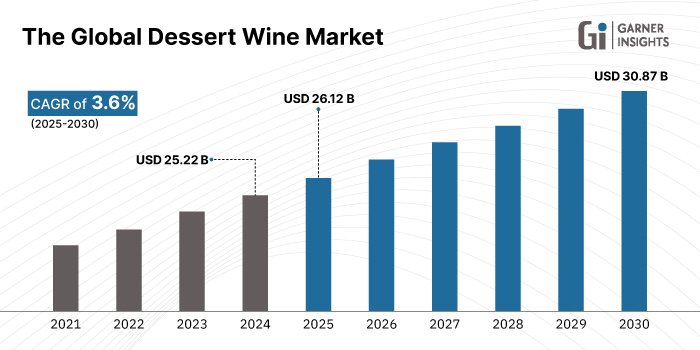

The global dessert wine market size was valued at USD 25.22 billion in 2024 and is projected to grow from USD 26.12 billion in 2025 to USD 30.87 billion in 2030, exhibiting a CAGR of 3.6% during the forecast period (2025-2030).

The global dessert wine market is characterised by steady expansion, propelled by shifting consumer preferences toward premium, indulgent, and speciality flavours. The sector captures around 7–8% of the wine industry, underpinned by post-dinner rituals, food pairing trends, and growing interest in artisanal products. Premiumization, driven by small-batch, noble-rot, botrytized wines and sustainability, with organic and biodynamic labelling, is reshaping the segment. Health trends also favour low-alcohol and low-sugar varieties. E-commerce channels and on-trade experiences in high-end restaurants further accelerate the market.

Global Dessert Wine Market Trend

Premiumization and artisanal varieties

Premiumisation remains the most compelling trend in dessert wines, driven by growing consumer affinity for small-lot, terroir-rich expressions such as Sauternes, Tokaji, and Icewine. These wines typically command a 30–50% higher price than standard counterparts, offering attractive margins. Consumers in North America and Europe increasingly appreciate handcrafted noble-rot styles, while luxury-conscious middle classes in China, India, and Southeast Asia drive growth in emerging markets.

- For example, in November 2024, Prestige Vineyards (India) launched Arkä, a premium mead dessert wine inspired by ancient recipes, now available in Maharashtra, Karnataka, Goa, and Arunachal Pradesh.

The focus on exclusivity and terroir narrative gives premium dessert wines a cultural and economic resonance.

Global Dessert Wine Market Driver

Culinary and food pairing momentum

Culinary prestige is a major growth driver for dessert wine, driven by its enhanced pairing potential in chef-crafted menus and upscale dining. Dessert wines are now more frequently featured at high-end restaurants and culinary festivals, aligning with multisensory dining trends.

- For example, in the U.S., the top 250 restaurants reported a 12% year-over-year rise in dessert wine orders, boosted by pastry chef collaborations.

Restaurants are collaborating with wine estates, like the Château de Fargues, pairing menus in New York, which pushes demand. Food festivals in Germany’s Mosel Valley also spotlight Eiswein and Riesling dessert wines. Such gastronomic integration moves dessert wine from niche to essential lifestyle categories.

Global Dessert Wine Market Restraint

High production complexity and climate risk

Production of botrytized and Icewine dessert wines is labour-intensive and climate-sensitive, creating structural entry barriers. These wines depend on specific conditions, morning fog and rot-inducing humidity for Sauternes/Tokaji, sub-zero temperatures for Icewine, leading to limited volumes and inflated costs (Icewine can cost three times more than standard wine). Climate change exacerbates unpredictability. Canada’s 2024 Icewine harvest was delayed by 10–14 days due to warm autumns, increasing labour and infrastructure costs. While producers invest in frost tunnels, canopy management, and extended ageing (3+ years), this capital expenditure restricts small producer participation. Consequently, only established estates or those with enough capital can scale production, preventing widespread adoption, though elite wines maintain shelf scarcity and “collector” status.

Global Dessert Wine Market Opportunity

Emerging market expansion

Emerging markets represent one of the strongest opportunities for dessert wine, especially across Asia-Pacific and Latin America. In India, a 2024 Mumbai luxury retailer launched a Tokaji and Port dessert box, achieving a 40% repeat purchase rate, demonstrating potential among urban luxury consumers.

- For instance, in January 2025, Inniskillin Winery, a global leader in Icewine, launched a limited-edition Riesling Icewine for export to Japan and Singapore, tapping into the region's demand for lighter, floral dessert wines.

Latin American countries like Brazil and Mexico are introducing dessert wine pairings at upscale venues, slowly building consumer familiarity. While infrastructure and consumer education remain nascent, these regions rapidly evolve into growth hotspots for dessert wine exports and consumption.

Product Type Insights

Still dessert wines continue to dominate due to their rich tradition, flavour complexity, and broad culinary compatibility. Classic examples such as Sauternes (France), Tokaji (Hungary), and Icewine (Canada and Germany) represent the pinnacle of winemaking craftsmanship, often involving botrytis (noble rot) or late-harvest processes to concentrate sugars and flavours. These wines appeal to sophisticated palates seeking balance between sweetness, acidity, and aromatic depth. Millennials and Gen Z, known for valuing experiential consumption, are growing interested in premium sweet wines, especially when branded with artisanal, biodynamic, or vegan labels.

Grape Type Insights

White grape varieties dominate the dessert wine category due to their natural acidity, which counterbalances the residual sugar and prevents cloying finishes. Grapes such as Riesling, Muscat, Chenin Blanc, and Gewürztraminer are particularly suited for crafting balanced, refreshing dessert wines with expressive aromatics. These wines’ versatility with a wide range of desserts, from fruit tarts and crème brûlée to cheeses, further reinforces their value in high-end hospitality. Their light colour, freshness, and lower alcohol content also appeal to health-conscious, moderation-minded drinkers.

Distribution Channel Insights

The off-trade segment leads the global dessert wine market, accounting for most retail sales due to its accessibility, variety, and rising digital adoption. Supermarkets, wine retailers, liquor stores, and online platforms dominate this channel, especially in North America, Europe, and Asia. Consumers increasingly purchase dessert wines like Icewine, Sauternes, and Moscato for home consumption, special occasions, and gifting, benefiting from promotional offers, curated pairings, and educational content provided in-store and online.

| By Product Type | By Grape Type | By Distribution Channel |

|---|---|---|

|

|

|

Regional Analysis

North America

North America is among the foremost regions for dessert wine, showcasing strong growth in both the U.S. and Canada. Consumer interest in premium, artisanal varieties, particularly late-harvest and Icewine, drives sales through fine dining, wine clubs, and online platforms. Notably, Icewines have gained significant international recognition in Canada, Ontario and British Columbia. In the U.S., regions such as California’s Napa Valley are breeding experimental dessert blends and wine tourism. Digital adoption is strong with DTC and e-commerce of dessert wines, accounting for around 25% of sales. Passionate wine culture, strong pairing trends, and institutional backing position North America as a major growth engine for dessert wine.

Europe

Europe remains the global heartland of dessert wine, inspired by centuries-old traditions in regions like Sauternes (France), Tokaji (Hungary), Sherry (Spain), and Port (Portugal). Cultural pairing rituals, dessert, cheese, and pâtisserie support consumer preference. Wine tourism, festivals (e.g., Rioja Dulce), and experiential tasting events strengthen the connection to terroir. Online sales in Europe have also grown, with over 43% of overall wine sold digitally. Europe’s entrenched culture, strong origin brands, and sustainability orientation preserve its leadership.

Asia-Pacific

Asia-Pacific is the fastest-growing region for dessert wines, fueled by rising disposable incomes, urban middle classes, and western-style consumption patterns. China’s evolving wine culture has spurred cross-border demand for premium dessert wines like Icewine and Sauternes. Japan and Australia, while mature, are innovating with low-alcohol styles catering to health-aware consumers. In India, solar-powered sustainable wineries (e.g., Sula Vineyards) and GI protections like Nashik Valley have encouraged growth. Initiatives by Australia’s wine agencies and tourism boards also promote premium dessert wines internationally. Digital-first strategies are prominent, 45 %+ of sales occur online, and joint promotions with e-tailers (Tmall, Amazon India) accelerate brand visibility.

Latin America

Latin America is an emerging market with modest but growing interest in dessert wines, particularly from regions already strong in still wine like Argentina and Chile. Local varietals and late-harvest wines are gaining traction domestically. Despite limited institutional backing, some cold-climate vineyards in southern Chile experiment with Icewine analogues. Chilean wine-tourism regions are beginning to include dessert wine tasting in itineraries, supporting niche demand. Per capita, consumption remains low compared to other regions, but rising gastronomy tourism (e.g., Atacama dessert experiences) and festival inclusion boost awareness. Distribution remains confined to speciality importers, but off-trade expansion and online retail platforms are gradually improving accessibility.

The Middle East & Africa (MEA)

The Middle East & Africa is a niche but emerging landscape for dessert wine. South Africa is leading regional production, as cool climate estates in the Western Cape produce botrytized and late-harvest offerings. Wine tourism is gaining momentum, especially in Cape Town’s wine routes. However, most Middle East countries have restrictive alcohol policies, limiting local access. North African regions like Morocco and Egypt see experimental sweet styles for upscale hotels serving tourism markets. E-commerce and private sales remain minimal, though duty-free airport platforms provide limited availability. Overall, MEA has moderate potential rooted in tourism and the luxury perception of dessert wines.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The global dessert wine market features both legacy and innovative producers. These companies pursue strategies like premium portfolio expansion, sustainability, flavoured varietals, and DTC channels to meet evolving consumer tastes.

De Bortoli Wines is renowned for its flagship dessert wine, Noble One, a botrytized Semillon that reinforces its global premium dessert positioning.

Sula Vineyards pioneered India’s dessert wine category with its Late Harvest Chenin Blanc. As domestic demand rises, Sula leverages regional branding and tourism to grow.

Dessert Wine Key players include

- Inniskillin

- Jackson-Triggs

- Pillitteri

- Peller Estates

- Sula Vineyards

- De Bortoli Wines

- Bonterra

- Brengman Family Wines

- Cellar 13 Winery

- Rombauer

- Oliver Winery

- Fun Wine Company

Recent Developments

- June 2025- Bonterra launched the Ranch Wine trio, lightly effervescent, low-alcohol dessert-style wines, expanding its eco-conscious portfolio and entering off-trade and DTC channels.

- February 2025- The Michigan-based Brengman Family Wines winery introduced a Gewürztraminer SGM (botrytized) dessert wine, blending noble-rot sweetness with aromatic complexity. This development signals diversification into premium botrytized styles.

- September 2024- Just Fine Wine (Canada) introduced seasonal dessert wine kits, Riesling Icewine Style, Chocolate Raspberry, Vanilla Bourbon, ahead of the holiday season.