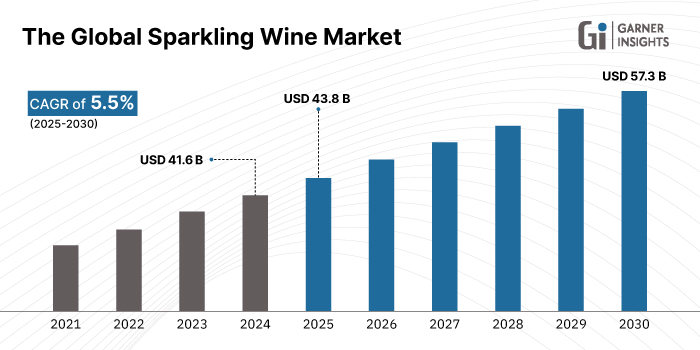

Sparkling Wine Market Size

The global sparkling wine market size was valued at USD 41.6 billion in 2024 and is projected to grow from USD 43.8 billion in 2025 to USD 57.3 billion in 2030, exhibiting a CAGR of 5.5% during the forecast period (2025-2030).

Key Insights

-

Champagne Leads the Sparkling Segment: Champagne continues to dominate the sparkling wine market, retaining the largest market share in 2024, driven by its heritage, stringent appellation rules, and global luxury appeal. The segment is projected to grow at a CAGR of 4.4% during the forecast period.

-

Glass Bottles Reign Supreme: Glass bottles accounted for 84.8% of sparkling wine packaging in 2024, underscoring consumer preference for traditional and premium packaging formats.

-

Europe at the Helm: Europe captured approximately 40% of global sparkling wine revenues in 2024, solidifying its role as the production and consumption hub of the category.

-

North America: Top Import Market: With 26.9% of global wine import value, North America emerged as the largest export destination for sparkling wine in 2024, highlighting growing consumer demand across the U.S. and Canada.

The global sparkling wine market is undergoing robust growth, fueled by rising global affluence, a shift toward premium lifestyle beverages, and expanding consumer interest in celebratory and social occasions. With millennials and Gen Z increasingly seeking premium and often lower alcohol or organic sparkling wines for special events and casual drinking, the market is gaining ground. E-commerce channels and speciality retail boost accessibility, while hospitality and event sectors further drive market demand. Regions like North America, Europe, and the Asia Pacific are experiencing particularly strong demand, with emerging markets such as India and China showing rapid uptake.

Sparkling Wine Market Trend

Convenience-oriented packaging

The rising demand for convenience-oriented packaging of flavoured sparkling wines is a significant trend. Producers are increasingly launching single-serve cans and slim bottles, mirroring the ready-to-drink movement observed in beer and cocktails. Consumers, particularly millennials and Gen Z, value portability, lower volume servings, and the novelty of on-trend flavours. In the U.S., canned formats capture a growing proportion of off-trade sales via supermarkets and online platforms.

- For instance, in September 2024, United Airlines announced the rollout of 250 ml aluminium cans featuring rosé and brut sparkling wines from female-led brands Just Enough Wines and Maker Wine, replacing single-use plastic bottles.

Retailers like Tesco and Target in North America are expanding shelf space for canned sparkling options, suggesting broader mainstream acceptance.

Sparkling Wine Market Driver

Expansion of premiumization and rising disposable incomes

The expansion of premiumization, especially in emerging markets, drives market growth. As global affluence grows, consumers are increasingly willing to spend on luxury and experiential products. Brands such as Moët & Chandon, Henkell & Co., and E&J Gallo are capitalising through premium launches and targeting gifting occasions, weddings, corporate celebrations, and festive holidays, with personalised packaging and online exclusives.

- For example, in October 2024, Chandon India celebrated its 10-year milestone by launching a limited-edition Vintage 2015, produced from its inaugural Nashik harvest, reflecting the premium and celebratory positioning.

As consumer affluence increases, demand shifts toward premium sparkling wine experiences with quality, individuality, and status signalling.

Sparkling Wine Market Restraint

High taxation on alcoholic beverages across key markets

A key restraint facing the sparkling wine market is the high taxation on alcoholic beverages across key markets, which can constrain price competitiveness and limit growth, especially for premium products. In countries such as the EU, the U.S., India, and parts of Southeast Asia, sparkling wine is often subject to higher excise duties, import tariffs, and label regulations than still wines. For example, in the U.S., state-level variations in alcohol taxes and distribution laws (e.g., franchise laws, direct shipments restrictions) complicate market entry for boutique and imported sparkling labels.

Smaller producers may find it challenging to absorb these costs, leading to reduced innovation and slower geographic expansion. For consumers, high retail prices due to taxation and import costs limit the frequency of consumption, making sparkling wine a niche, occasional beverage in some regions.

Global Sparkling Wine Market Opportunity

Expansion through digital DTC channels

Expansion through digital direct-to-consumer (DTC) channels is a significant opportunity. As retail moves online, producers leverage e-commerce platforms, tasting kits, and virtual sommeliers. Expanding into emerging markets like China and India is accelerated by localised DTC platforms and cross-border e-commerce (e.g., Tmall, Amazon India), offering exclusive premium ranges.

- For example, in June 2025, at the Just Drinks Excellence Awards, Henkell Freixenet received Innovation and Product Launch awards for its alcohol-free Freixenet Cordon Negro 0.0%, demonstrating expansion into DTC and health-forward segments.

As DTC share grows, suppliers can bypass traditional retail margins, control brand messaging, and gather rich consumer data, enabling demand forecasting, personalised offers, and direct margin capture.

Type Insights

Champagne remains the gold standard, capturing the largest market share within sparkling wine due to its strong heritage, strict appellation protection, and global prestige. Champagne’s appeal stems from its association with luxury, ceremony, and milestone events, with brands like Moët & Chandon, Veuve Clicquot, and Dom Pérignon commanding premium pricing and international recognition. The segment’s growth is also driven by expanding millennial and Gen Z demand in the U.S. and Asia, where Champagne’s status symbolism aligns with rising disposable incomes and celebratory culture.

Packaging Insights

Glass bottles dominate sparkling wine packaging with an 84.8% share in 2024. Their premium perception, recyclability, and ability to mature wines make them the go-to choice for luxury Champagne and quality regional bubbles. Glass bottles support traditional uncorking and sabrage rituals vital to customer experience. Regulatory frameworks like the TTB enforce bottle use in certain markets, ensuring standard sizing and preserving tradition. With strong demand for sustainable premium wines, glass bottles remain foundational due to their prestige, sensory neutrality, and environmental credentials.

Price Segment Insights

Luxury sparkling wine, Champagne and aged vintage are the fastest-growing price tiers, commanding the highest per-litre margins. This segment is fueled by strong demand from affluent consumers, gifting culture, and milestone celebrations. Brands like LVMH and Pernod Ricard drive innovation with sustainable packaging and limited-edition prestige cuvées aligned with luxury values. E-commerce and travel retail enhance global reach. Sustainability initiatives and eco-designed bottles further elevate the brand cachet. With rising global wealth and experiential spending, luxury sparkling remains a main growth pillar.

Production Method Insights

Traditional-method sparkling wine dominates production due to its association with quality and ageing potential. Representing Champagne, Crémant, and quality premium bubbles globally, this method commands higher price points while underpinned by rigorous fermentation and ageing on lees. It appeals to consumers seeking depth, complexity of flavours, and luxury. Premium consumers in the U.S., Europe, and Asia continue to favour traditional-method cuvées, reinforcing segment stability. The method’s premium pricing and international brand recognition ensure its dominance in the upper market tier.

Distribution Channel Insights

On-trade channels are leading distribution segments. Restaurants, bars, and hospitality venues drive brand discovery and premium positioning. Sparkling wine is a staple in fine dining, casual brunch, and celebratory settings where customer experience and pairing expertise matter. The growth of lifestyle dining, wellness, and social media-friendly venues encourages sparkling wine consumption, especially by younger demographics. On-trade supports higher margins and sampling of niche or vintage cuvées, boosting brand equity. Post-pandemic rebounds in tourism, fine dining, and event hosting have further revived demand, securing on-trade as the dominant, experiential-focused channel.

| By Type | By Packaging | By Price Segment | By Production Method | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Analysis

Europe - Dominant region

Europe is the powerhouse of the sparkling wine market, grabbing roughly 40% of global revenues in 2024. The region is steeped in tradition, home to Champagne (France), Prosecco (Italy), Cava (Spain), and Crémant (France, Luxembourg). The region’s extensive on-trade network, festivals, weddings, and holiday markets bolster domestic consumption. European producers have heightened focus on higher-priced, appellation-driven wines (e.g., vintage Champagne, Franciacorta, Crémant). Innovation in flavour profiles (e.g., organic Rosé, lowalcohol) targets millennials and wellness-oriented consumers.

North America - Significant and mature market

North America is the world’s largest export destination, holding 26.9% of global wine import value in 2024. The market is driven by premium dining culture, millennial/Gen Z social behaviours (brunch, celebrations), and strong domestic production. California leads with méthode champenoise sparkling exports. The on-trade sector, restaurants, bars, events, off-trade (supermarkets), and e-commerce form a balanced distribution mix. Consumption trends show rising demand for Rosé and canned formats among younger demographics. DTC platforms and vineyard tourist experiences (e.g., Napa, Finger Lakes) enable premium brand engagement.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The global sparkling wine market features an interplay of established houses and agile newcomers. These players focus on premiumization, sustainability, new packaging formats, DTC channels, and geographic expansion to meet shifting consumer preferences and capture emerging market share.

Treasury Wine Estates (TWE): Treasury Wine Estates (TWE) has emerged as a leader in sparkling wine. TWE has expanded its DTC presence via AI-enabled “Project Sommelier” and membership clubs. Their balanced growth strategy emphasises premium rosé, organic lines, and Asian market expansion, driving double-digit growth in key segments.

Latest Development:

- In June2025, Treasury Wine Estates (TWE) unveiled a new, purpose-built AUD 15 million (USD 10 million) facility in South Australia's Barossa Valley dedicated to producing its next generation of low- and no-alcohol wines.

Major producers of sparkling wine include

- LVMH (Moët & Chandon, Veuve Clicquot)

- Perrier-Jouët

- Gruppo Italiano Vini

- Constellation Brands

- Treasury Wine Estates

- Casella Family Brands

- Accolade Wines

- Asahi Group

- Bronco Wine

- Casella

- Concha y Toro

Recent Developments

- October 2024 - Moët & Chandon (LVMH) launched the first eco-designed bottle, reducing weight by 25% and CO₂ emissions by 30%, under the LVMH LIFE 360 sustainability roadmap.