Table Wine Market Size

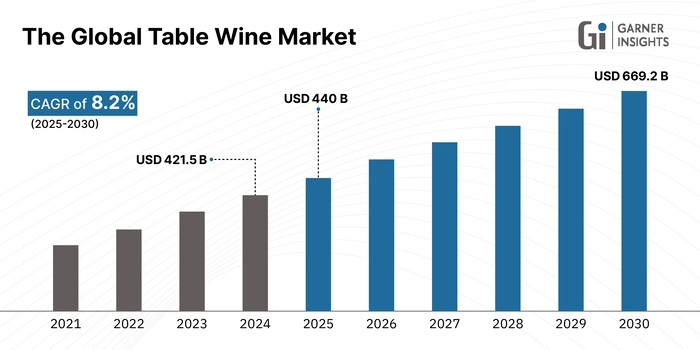

The global table wine market size was valued at USD 421.5 billion in 2024 and is projected to grow from USD 440 billion in 2025 to USD 669.2 billion in 2030, exhibiting a CAGR of 8.2% during the forecast period (2025-2030).

The global table wine market is experiencing robust growth fueled by premiumization, shifting consumer preferences toward higher-quality and health-oriented products, and expanding e-commerce adoption. Wine’s defining traits, terroir, pairing compatibility, and lower alcohol varieties, merge well with wellness trends and gastronomic experiences. While Europe remains the largest producer and exporter, emerging markets like North America and Asia-Pacific are growing rapidly due to rising incomes and evolving taste patterns. Sustainability and transparency, from regenerative agriculture to carbon-neutral packaging, resonate with eco-conscious consumers.

Global Table Wine Market Trend

Premiumization and terroir-driven wines

Premiumization is reshaping the table wine landscape, with consumers increasingly willing to pay for wines that convey origin, craftsmanship, and authenticity. High-end varietals like Barolo, Barbaresco, Napa Cabernets, and Burgundy Pinot Noirs are gaining traction as lifestyle statements. Consumers are drawn to the terroir narrative, evidenced by 64% of professionals identifying sustainability and origin-focused wines as growth drivers, highlighting wines like Italian Super-Tuscans and Californian heritage labels. Regulatory frameworks like the EU’s Protected Designation of Origin and U.S. state appellation systems bolster provenance claims. Premiumization is also visible in dining trends, and fine-dining venues report double-digit growth in wine spending per head, with secondary and tertiary cities gaining momentum post-pandemic.

Global Table Wine Market Driver

E-commerce and digital D2C channels

E-commerce and direct-to-consumer platforms have become vital growth engines for table wine. In North America and Europe, online sales represent 30% of wine revenue, driven by subscription clubs, virtual tastings, and pairing content. Producers like Treasury Wine Estates and Constellation Brands have launched personalised D2C platforms, enabling targeted offers and seasonal releases.

- For example, in December 2024, Full Glass Wine Co. acquired Wine Access & Cameron Hughes, accelerating its DTC platform, projecting over USD 200 million revenue in 2025.

Emerging markets such as China and India also benefit from local portals on Tmall and Amazon India, which offer curated regional wine assortments. Blockchain traceability solutions offer vineyard-to-bottle authenticity and appeal to consumers who value transparency.

Global Table Wine Market Restraint

Health and regulatory pressures

Table wine faces growing resistance from health-conscious consumers and tighter regulations. In the U.S., 2024 saw an 8% drop in table wine sales, mirroring a broader shift toward alcohol moderation and non-alcoholic drinks. UK wine consumption is down 19% since 2019, especially among Millennials and Gen Z, though they still pay more per bottle. Governments are imposing stricter labels, advertising restrictions, and taxation, particularly in Europe and Australia, to combat public health concerns. This regulatory backdrop raises production and compliance costs, constraining price growth. To counterbalance, producers are introducing low-alcohol and non-alcoholic variants and highlighting health benefits like antioxidants. Ongoing regulatory shifts will influence pricing, labelling, and promotional strategies through 2030.

Global Table Wine Market Opportunity

Health-oriented and functional wines

Health and wellness drivers offer a potent opportunity for table wine innovation. Low- and no-alcohol variants are capturing interest, with developments led by brands like FitVine, which markets zero-sugar wines. Consumers increasingly seek wines with lower alcohol, fewer calories, and functional ingredients.

- For example, in June 2025, Treasury Wine Estates (owner of Penfolds) opened a AUD 15 million “NOLO” facility in Barossa to produce 8% ABV lines, including Squealing Pig and a new Sorbet brand releasing in October 2025.

Leading producers like Bonterra and Frey are launching certified biodynamic and vegan wines. As consumer wellness priorities evolve, these functional and sustainable versions could command premium pricing and attract younger, health-savvy demographics.

Wine Variety Insights

Red wine dominates the table wine market with approximately 50% share, driven by global preference for fuller-bodied and savoury-flavoured profiles. Consumers in North America, Europe, and Asia, especially China, favour red varietals like Cabernet Sauvignon and Merlot for their food-pairing potential and ageing qualities. Red wine’s popularity is reinforced by its association with health benefits such as resveratrol, bolstering prestige among older demographics. Wine tourism regions from Napa to Bordeaux showcase red blends and single-varietal tours, enhancing consumer engagement.

Packaging Insights

Glass bottles hold over 80% of table wine sales. They remain favoured for premium presentation, bar and restaurant standards, and ageing potential. Glass provides sensory neutrality, recyclability, and consumer perception of quality. Innovations like lightweight bottles reduce emissions and cost. For premium wines, bottle presentation is essential; the tactile feel of glass enhances consumer experience. Environmental policies (EU carbon footprint regulations, U.S. state recycling mandates) have pushed further optimisation. This format dominates on-trade, travel retail, and DTC channels, supported by tradition and regulation.

Grape Variety Insights

Cabernet Sauvignon dominates the global table wine market due to its widespread cultivation, bold flavour profile, and strong consumer recognition. Known for its deep colour, high tannins, and ageing potential, this varietal is widely favoured in Old and New World wine regions, especially in France (Bordeaux), the U.S. (Napa Valley), Chile, and Australia. Its adaptability to different climates and soils has made it a staple in global wine production. Its association with structured, full-bodied wines appeals to traditional wine drinkers and collectors alike, while newer producers in Asia and Latin America increasingly focus on the varietal to attract global export markets.

Price Tier Insights

The premium tier is growing rapidly, supported by consumer willingness to pay for quality, origin, and brand storytelling. Wine drinkers, especially millennials and Gen Z, are trading up, opting for quality venues and experiences. Premium wines benefit from higher margins, allowing producers to invest in terroir-driven campaigns, masterclasses, and DTC offerings. Regions like Napa, Burgundy, Barossa, and Margaret River thrive in this tier. Producers are launching small-lot reserve lines and en primeur sales to sustain interest. Sustainability certifications (organic, biodynamic) further elevate perceived value.

Distribution Channel Insights

Off-trade channels, including supermarkets, speciality stores, and online wine retail, constitute around 70% of total sales. Convenience, selection, and availability drive consumer preference, especially in mature markets. E-commerce enables subscription models, curated tasting boxes, virtual tastings, and personalised pairing suggestions, enhancing customer loyalty. For producers, it offers superior margins, real-time data, and global reach. While logistics and regulation remain hurdles, shifting from on-trade (especially post-pandemic) makes off-trade, particularly digital, the most dominant distribution strategy.

| By Type | By Grape Variety | By Packaging Type | By Price Tier | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest table wine market with a 35% share, anchored by U.S. and Canadian consumption patterns. Premiumization drives growth in regions like Napa and Okanagan, where high-end labels and wine tourism flourish. Millennials and Gen Z favour lighter styles (rosé, Pinot Gris) and eco-conscious wines. E-commerce and DTC channels are robust, with digital accounts for 30% of sales. Government incentives include the relaxed shipping laws of the United States (e.g., New York Wine Shipping Bill 2024) and Canadian agricultural grants aiding vineyard tech and exports. Off-trade and premium segments maintain growth through consumer adaptation, innovation, and strong policy support.

Europe

Europe holds a 30% share and is at the heart of table wine production and consumption. Traditional wine cultures from France, Italy, and Spain remain powerful, supported by appellation systems and domestic lag but strong export infrastructure. The EU’s CAP funds sustainable viticulture and vineyard restructuring, including grants for lighter bottles and eco-practices. Producers pivot toward higher-value, terroir-driven wines, eco-certifications, and tourism experiences. Digital channels are accelerating, and 43% of wine is sold online. Europe’s resilience lies in balancing tradition with modernisation, leveraging policy support and premiumization despite macro consumption pressures.

Asia Pacific

Asia Pacific is the fastest-growing region, with China and India driving demand alongside Australia and Japan. Chinese consumers, particularly younger cohorts, are shifting toward white and rosé wines, and the market is now the world’s fifth-largest by volume. India shows explosive growth, albeit from a small base, supported by Nashik’s Wine Tourism & Heritage Zone initiative and GI recognition. Australia enjoys domestic white varietal momentum (Chardonnay up 31%). Government-backed export promotion in China and India, as well as vineyard modernisation policies, further support expansion. Rapid urbanisation and rising incomes suggest this region will continue outpacing global averages.

Latin America

Latin America holds about 10% of the market share, with Argentina and Chile leading in production and exports. Chile has leveraged trade agreements (e.g., with China) to surpass Australia in exports. Domestic demand is primarily for red wine, with growing interest in premium whites and rosés. Wine tourism in Mendoza and the Casablanca Valley propels niche markets and elevates regional recognition. Government support includes Chile’s export incentives and Argentina’s vineyard investment funds. While infrastructure remains inconsistent, off-trade growth and urban wine culture are emerging. Latin America’s potential lies in premium niche development and trade diversification.

Middle East & Africa

The Middle East & Africa present niche potential shaped by tourism and evolving regional economies. South Africa is the regional leader, with Western Cape estates producing high-quality table wines for domestic and export markets; the government funds tourism and PGI initiatives. Despite Islamic-majority restrictions, duty-free outlets and hotel demand support niche consumption. North Africa (Morocco, Egypt) is experimenting with exports and gastronomy pairing, especially at tourist resorts. Regulatory complexities and climate challenges remain barriers. However, wine tourism and economic diversification initiatives in South Africa provide a foundation for cautious but promising growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Competitive Analysis

A mix of legacy and innovative players dominates the global table wine market. Brands focus on premiumization, sustainability, and expanded DTC (direct-to-consumer) channels. Smaller producers and regional wineries emphasise terroir, organic credentials, and experiential tourism to carve niches and build brand loyalty.

Company Market Share

Treasury Wine Estates (TWE): TWE commands a strong position with brands like Penfolds, Yellow Tail, and Stags' Leap. The company emphasises premium varietals, sustainable practices, and digital DTC platforms.

Latest News

- In April 2025, TWE completed its Stone & Moon winery acquisition in China’s Ningxia region, advancing its localised Penfold production strategy.

Accolade Wines/Vinarchy: Vinarchy emerges as a leading global wine entity with over AU$1.5 billion in annual revenue, following the April 2025 merger of Accolade Wines and Pernod Ricard's ANZ operations. The merger strengthens global scale and leverages premium assets like Jacob's Creek and Campo Viejo.

Key market players in table wine:

- Treasury Wine Estates

- Constellation Brands

- Pernod Ricard

- E. & J. Gallo

- Accolade Wines

Recent Developments

- June 2025- Vinarchy (Australia) announced a AUD 30 million Barossa Valley expansion, creating a “centre of excellence” for premium and sparkling wine at Rowland Flat, part of a twin-hub strategy consolidating operations.

- October 2024- White Castle Vineyard (Wales) opened a new on-site winery facility equipped with advanced harvesting and processing equipment to enhance production control and quality, signalling investment in domestic growth.